It is common knowledge among marketers that it is far easier and less expensive to increase sales from existing customers than it is from winning over new customers. Your current customers know ‘who you are’ and ‘what you do’, and therefore, demand less of your time and money to educate and attract.

With this principle in mind, it makes good sense to develop marketing strategies that will increase your share of customer wallet.

But how do you know what your share of wallet is for a given customer?

Most likely, you are estimating your share of customer wallet based on how much they spend with you. For example, say a manufacturer of earth-moving equipment, Heavy Machines, wants to understand their share of spend with Customer X. Heavy Machines might apply the following ‘rule of thumb’ to estimate their share of wallet:

Customer X spends $100,000 per annum with our company, and we are 1 of 3 suppliers to them. Therefore, our estimated share of Customer X’s spend is 33%, and there is potential to gain an additional $200,000 in sales with them.

This inward-looking method to estimate the size and share of customer wallet is completely flawed, and here’s why:

Empirical research by marketing professors R. Y. Du (University of Georgia), W. A. Kamakura (Duke University), and C. F. Mela (Duke University) have shown there is no correlation between the volume of sales a customer has with your company, and the volume of sales they have with your competitors.

Watch the video below:

So, although Customer X spends $100,000 with your company, they might be spending $500,000 with your competitors!

Thankfully, some clever marketing academics and professionals have developed a simple and robust predictive model to help companies calculate the size and share of a customer’s wallet with almost perfect accuracy.

The ‘Wallet Allocation Rule’ developed by Timothy L. Keiningham, Lerzan Aksoy, Alexander Buoye, and Bruce Cooil is based on your brand’s rank among the number of brands a customer uses for a particular product or service (i.e. is your brand the customer’s first choice? Second? Third? etc.) Knowing these two values, your rank and number of brands used, will allow you to confidently predict share of customer wallet.

To calculate your share of customer wallet using the Wallet Allocation Rule, the authors recommend following these three steps:

1. Establish the number of brands, or firms, a customer uses for the product category you wish to analyse.

2. Survey the customer to obtain your rank – are you the customer’s 1st preference, 2nd, 3rd, etc. In the case of a tie, take the average. For instance if 2 companies tie for 1st preference, each is assigned a rank of 1.5.

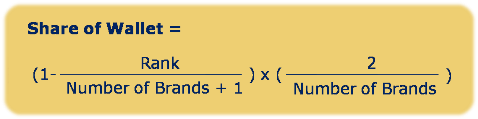

3. To arrive at a brand’s share of wallet for a given customer, plug the brand’s rank and the number of brands into the Wallet Allocation Rule formula:

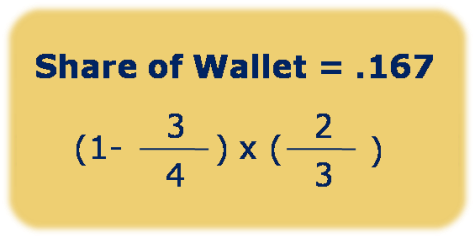

Example: Heavy Machines knew they were 1 of 3 suppliers to Customer X. They undertook a survey to identify that they are Customer X’s 3rd preference.

Heavy Machine’s share of Customer X’s spend is 16.7%. So, if Customer X is spending $100,000 with Heavy Machines, they are spending $300,000 and $200,000 with the #1 and #2 ranked suppliers, respectively.

Of equal importance, Heavy Machines asked Customer X ‘what they like best about their 1st and 2nd ranked suppliers’. They found out that Customer X likes the ‘after-sales service’ for the #1 supplier and ‘product availability’ for the #2 supplier.

Heavy Machines can now develop targeted marketing strategies to increase its share of wallet with Customer X. They have a clear understanding of what Customer X values most: ‘after-sales service’ and ‘product availability’….and, if Heavy Machines can get Customer X to switch suppliers, they could increase sales by $500,000 with just one customer!